Declining Bulk Billing Rates: Will the Federal Budget Reverse the Trend?

- Benchmarking, News

- Chris Smeed

- June 1, 2023

The dynamics surrounding bulk billing rates have been the subject of intense discussion in recent years, and they have been increasingly brought into focus by the latest federal budget announcement. As someone who once managed a bulk billing clinic, I understand the many challenges of running a bulk billing general practice. Financial sustainability, after all, is the bedrock of operational viability – without financial sustenance, a clinic cannot continue to offer its invaluable services to patients.

While bulk billing practices are essential in the community, a shift towards practices charging for their time is a positive trend. It emphasises that their services are in demand and valued by the public. This changing landscape reflects a growing acknowledgment of the quality care these practices provide and their importance in our healthcare system.

The Federal Budget and Its Implications

Level E Consults

The 2023 Federal Budget introduced a new Level E consultation for appointments extending beyond 60 minutes. Speaking from anecdotal evidence, it’s rare for General Practitioners (GPs) to have consultations exceeding this length. To explore the financial implications of this change, we delved into data obtained from the Touchstone dataset for the impact of Level E consults to General Practices.

Exploring Rebate Increases: Levels A to D

Under the new Federal Budget, it is worth noting that the bedrock consultations, which are Levels A through D, will see a welcome boost in their rebates. A 4% increase has been implemented across the board for these consultation levels. To detail the changes:

- The rebate for a Level A consult (Item 3, a short consult) has been increased from $18.20 to $18.95.

- The rebate for a Level B consult (less than 20 minutes) is now $41.40, up from $39.75.

- A Level C consult (20 minutes to 40 minutes) has seen its rebate rise from $76.95 to $80.10.

- Finally, a Level D consult (40 minutes to 60 minutes) now has a rebate of $118.00, a significant increase from $113.30.

These adjustments represent an increase of 4% for standard consults. As a result, practices should take the time to reassess their consultation mix in light of these changes. With the updated rebates, you can forecast a potential increase in revenue for these foundational consultation levels.

Tripled Bulk Billing Incentives: 10990 & 10991 and MMM items

For specific segments of the patient population, including children aged 15 and under, pensioners, and concession card holders, the Federal Budget has made notable adjustments. The bulk billing incentives for 10990 & 10991 and relevant Modified Monash Model (MMM) items have been tripled, potentially significantly impacting practices serving large numbers of these patients.

The adjusted incentive amount depends on the practice’s location, as classified under the “Modified Monash Model” system. To summarize the changes:

- For MMM1 areas (metropolitan), the incentive has risen from $6.60 to $20.65.

- In MMM2 areas (e.g., Launceston, Tas), the incentive has increased from $10.05 to $31.40.

- In MMM3 areas (e.g., Cessnock, NSW) and MMM4 areas (e.g., Port Augusta, SA), the incentive has increased from $10.65 to $33.35.

- For MMM5 areas (e.g., Renmark, SA), the incentive has increased from $11.35 to $35.40.

- In MMM6 areas (e.g., Lightning Ridge, NSW), the incentive has increased from $11.95 to $37.40.

- Finally, in MMM7 areas (e.g., Thursday Island, Qld), the incentive has jumped from $12.70 to $39.65.

These increased bulk billing incentives could significantly bolster practice revenue, especially for those practices serving many patients who fall into these groups. However, this would apply only if the practice adopts bulk billing and the newly increased incentive amount surpasses the private gap fee charged to patients.

Bulk Billing Rates and the Touchstone Dataset

What is the Touchstone Dataset?

Firstly, let’s go into detail about the Touchstone dataset before analysing the potential for Level E consults. Touchstone is a feature within the Cubiko product which allows General Practices to opt-in their financial and billing data to a de-identified, aggregated data set. When writing, the Touchstone data set has 640 medical practices opted-in, one of the largest benchmarking datasets for Australian primary care.

Touchstone: How do we measure Bulk Billing rate?

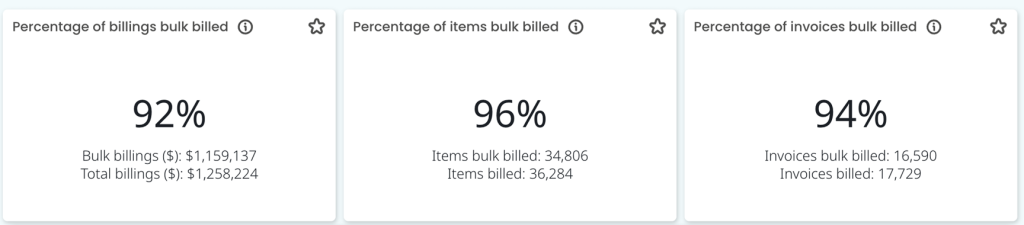

There are primarily three different ways to measure the bulk billing rate across a medical practice.

Touchstone, and what we’ve discussed in this blog post is measuring the percentage of invoices bulk billed. The reason we’re measuring invoices, is we’re trying to ascertain what percentage of patient appointments are bulk billed, compared to those privately billed. Percentage of invoices which generally corresponds to a service to a patient, is the closest for this measure. This is measured as below.

Bulk Billing rates across Australia

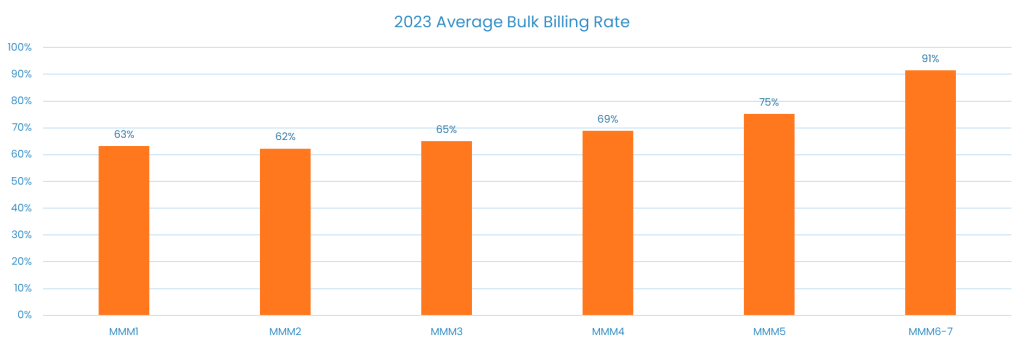

Through the Touchstone dataset, we have analysed the bulk billing rates as a percentage of invoices. Medical practices across Australia in the different Modified Monash Models (MMM):

- MMM1 – 63% Bulk Billing as a Percentage of Invoices

- MMM2 – 62% Bulk Billing as a Percentage of Invoices

- MMM3 – 65% Bulk Billing as a Percentage of Invoices

- MMM4 – 69% Bulk Billing as a Percentage of Invoices

- MMM5 – 75% Bulk Billing as a Percentage of Invoices

- MMM 6-7 – 91% Bulk Billing as a Percentage of Invoices

Many assumptions can be made about why Bulk Billing rates are higher in regional areas. Firstly that the bulk billing incentive is higher, and secondly could be due to the lower access of healthcare. It’s hard to say. Overall, what we can see from the Touchstone dataset is a stark contrast of bulk billing rates between MMM regions.

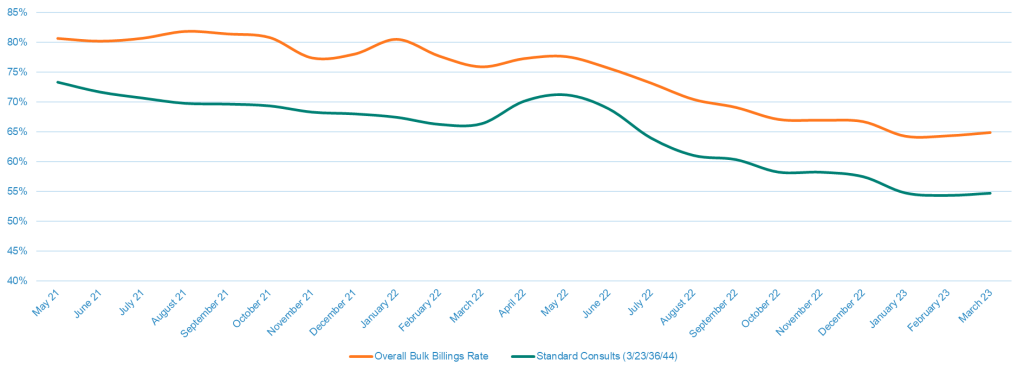

Secondly, let’s analyse the trend of bulk billing rates across Australia and how they’ve changed since May 2021. We can see that national bulk billing rates across the Touchstone dataset were 81% in May 2021, remaining steady at around 65% in March 2023.

The Standard Consults (Item 3, 23, 36 & 44) are the green line below. We prefer to use this as a measure for the true bulk billing rates across practices. Whether a practice bulk bills a standard consult or charges a private gap fee. We prefer this method for the true bulk billing rate for medical practice because it is the bread-and-butter work a practice does daily. It is less susceptible to item variation of bulk billing behaviour.

There are variations throughout the year. For instance, the total bulk billing rate is higher each year in January and February. This is due to the prevalence for medical practices to start chronic disease management plans (e.g. GPMPs) with their patients at the start of the year. The second noticeable season variation is in April, May and June each year. This is primarily due to flu season, which would result in the bulk billing rate noticeably increasing and the increase in the bulk billing rate of standard consults.

Will the budget move the needle on bulk billing rates?

Now that we’ve discussed in detail the potential ways the budget will affect bulk billing, and secondly what the current bulk billing rates are across Australia and what trends currently impact them. Let’s discuss the specifics of the Federal Budget and how they may or may not impact bulk billing rates.

It’s amazing that General Practitioners and medical practices across Australia are valued for their time. There is no shame in mixed billing and charging a private fee for the outstanding patient care practices provide. There is a value to that, and patients identify that value, as we can see from mixed billing rates across Australia without dramatic drops in practice attendance. Note we’ve made an assumption of practice attendance, but anecdotally I don’t know any practices that suddenly had empty appointments booked after moving to a mixed billing model.

The Budget’s Case Study into Bulk Billing

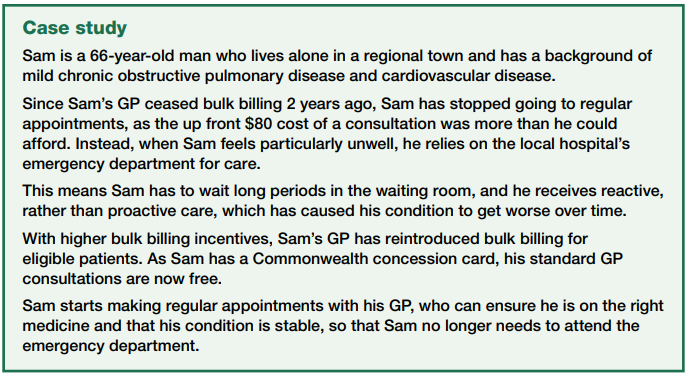

Here is a below excerpt from the Federal Budget Factsheet for Health that highlights a very specific outcome of the budget and how it may affect a patient’s experience with fees.

In this example, although it isn’t classified whether Sam is a concession card or healthcare card holder, let’s make the assumption that Sam has a healthcare card. First of all, Sam lives in a regional town. There is a high chance then that in that town, the General Practice would be bulk billing, or at least for those eligibility types a bulk billing practice. But we’ll go along with the example in that the practice has stopped bulk billing. The time period of two years ago is odd, considering the dramatic changes in bulk billing rates have been in the last 12 months, but let’s ignore that.

With the higher bulk billing incentive, the General Practitioner has reintroduced bulk billing for eligible patients. This is a really good point, and does indicate a potential for the Federal Budget to impact bulk billing rates across Australia. The fact that the General Practitioner is eligible for the bulk billing incentive when bulk billing services for Sam, and that same bulk billing incentive has been tripled could very well have an impact on whether Sam is bulk billed or privately billed for the service. With regional areas, let’s say MMM5, the incentive has increased from $11.35 to $35.40. For a standard consult, say an Item 23 the incentive (with the 4% indexation from the Federal budget), is now $41.40, up from $39.75.

Combining the bulk billing incentive item with the standard consult for Sam, the total rebate for Sam is $76.80, which is in fact less than the previous $80 private fee. This may be semantics, the total rebate amount depends on what MMM region in fact Sam’s medical practice resides in. Would a General Practitioner bulk bill a patient if it is lower than their private fee for certain eligibility types? That is completely up to that practitioner.

The introduction of Level E Consults

Will the introduction of Level E consults change bulk billing rates across Australia? Simply put, no. We’ve deep-dived into the data on Level E consults that analyse the average amount a medical practice would increase billings from for current consultations that are charged as a D and go over 60+ minutes.

Will the Federal Budget Impact Bulk Billing Rates?

Despite the notable changes introduced in the Federal Budget, the overall impact on bulk billing rates appears minimal. The budget presents measures such as a triple bulk billing incentive, the introduction of Level E consults, and a 4% indexation of standard consults, which may affect bulk billing rates marginally.

However, it is important to clarify that these measures are not necessarily aimed at increasing bulk billing rates, nor is it the desire of the profession. While these initiatives might incentivise bulk billing for specific patient groups, where the increased incentive is higher than the private gap fee, they are unlikely to cause a drastic increase in practices that bulk bill all patient cohorts.

Conclusion

The landscape of bulk billing is changing, and the Federal Budget reflects that. While it may benefit bulk billing practices, it is unlikely to cause a dramatic rise in bulk billing rates. As such, we expect a continued trend of patients valuing general practices for their services and time. In this context, the decline in bulk billing rates shouldn’t be seen as a negative but rather as a testament to the increasing recognition and valuation of the invaluable service provided by our healthcare practitioners. For practices looking at whether to change their fee schedules or bulk bill more patients we recommend you forecast the changes highlighted in this article and the Federal Budget to navigate this new environment. As always, data is your friend during uncertainty.

Trusted, reliable, loved by practices